colorado springs co sales tax rate

The latest sales tax rates for cities in Colorado CO state. The Colorado Springs Colorado sales tax is 825 consisting of 290 Colorado state sales tax and 535 Colorado Springs local sales taxesThe local sales tax consists of a 123 county.

Colorado Springs Cost Of Living Colorado Springs Co Living Expenses Guide

What is the sales tax rate in Manitou Springs Colorado.

. The Geographic Information System GIS now allows Colorado taxpayers to look up the specific sales tax rate for an individual address. The current sales tax in Colorado is 29. The GIS not only shows state sales tax information but.

Lowest sales tax 29 Highest sales tax 112 Colorado Sales Tax. Groceries and prescription drugs are exempt from the Colorado sales tax. The Colorado Springs Colorado sales tax is 290 the same as the Colorado state sales tax.

The minimum combined 2022 sales tax rate for Colorado Springs Colorado is. The December 2020 total local sales tax rate was 8250. Its important to note this does not include any local or county sales tax which can go up to 83 for a total sales tax rate of 112.

You can print a 82. Rates include state county and city taxes. Box 1575 Colorado Springs CO 80901-1575.

Average Sales Tax With Local. 2020 rates included for use while preparing your income tax deduction. Sales Tax Division PO.

This is the total of state county and city sales tax rates. These taxes are sent to the State of Colorado Includes all food sales Glenwood Springs SalesAccommodations tax goes directly to the City. The current total local sales tax rate in Colorado Springs CO is 8200.

Colorado has state sales. To tal Tax rate with Accommodation Tax. Some cities in Colorado are in process signing up with the SUTS program.

What is the sales tax rate in Colorado Springs Colorado. Additional questions can be answered by contacting the Sales Tax Department at 719 385. All about taxes in Colorado Springs -- our tax rates sales tax property tax and income tax and Taxpayers Bill of Rights TABOR information.

Cities that have not yet signed up will be shown with a red exclamation mark beside their sales tax rate. 2022 List of Colorado Local Sales Tax Rates. Beginning July 1 2022 retailers must collect a 027 retail delivery fee on every retail sale.

These taxes are sent to the State of Colorado Includes all food sales Glenwood Springs SalesAccommodations tax goes directly to the City. The Colorado state sales tax rate is 29 and the average CO sales tax after local surtaxes is 744. This is the total of state county and city sales tax.

The 82 sales tax rate in Colorado Springs consists of 29 Colorado state sales tax 123 El Paso County sales tax 307 Colorado Springs tax and 1 Special tax. Recent Colorado statutory changes require retailers to charge collect and remit a new fee. Our mailing address is.

290 Is this data incorrect Download all Colorado sales tax rates by zip code. To tal Tax rate with Accommodation Tax. Colorado Springs Sales Tax Rates for 2022.

Colorado Springs in Colorado has a tax rate of 825 for 2022 this includes the Colorado Sales Tax Rate of 29 and Local Sales Tax Rates in. The City of Colorado Springs sales and use tax. The minimum combined 2022 sales tax rate for Manitou Springs Colorado is.

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

520 S Circle Dr Colorado Springs Co 80910 Loopnet

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

Sales Tax Information Colorado Springs

How Colorado Taxes Work Auto Dealers Dealr Tax

Lodging Taxes On Colorado Springs Hotel Rooms Rank Among The Nation S Lowest Study Finds Business Gazette Com

Fuel Taxes In The United States Wikipedia

Appeals Process Notice Of Valuation El Paso County Assessor

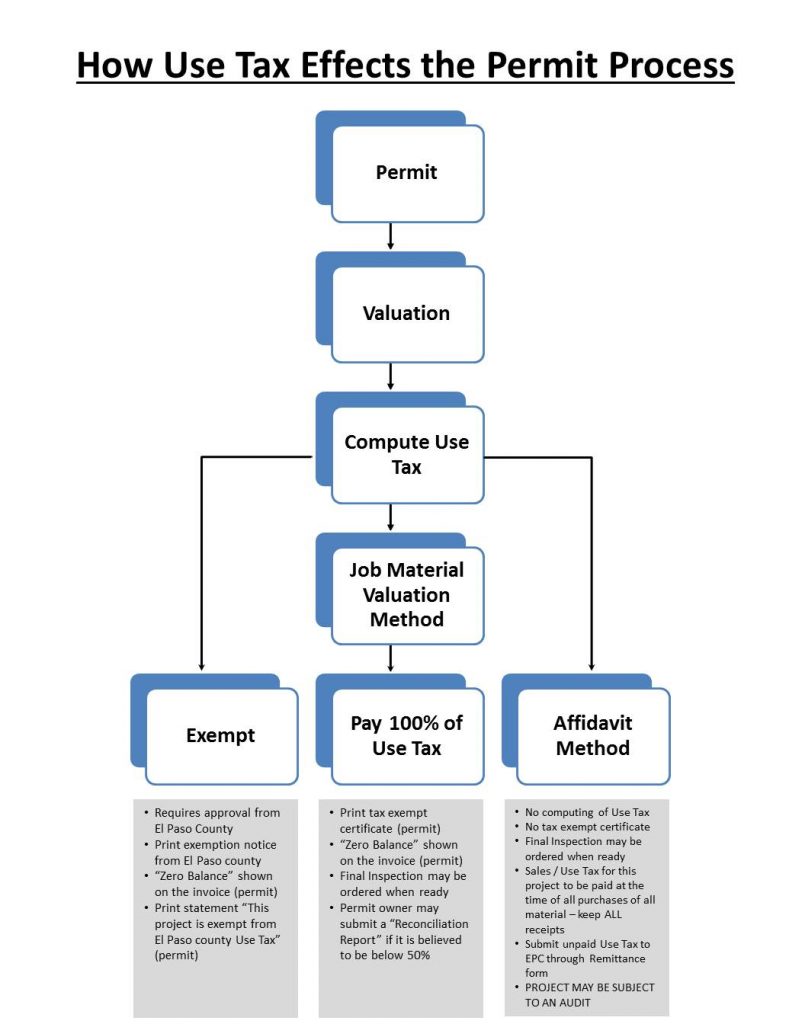

Sales And Use Tax El Paso County Administration

Taxes In Colorado Springs Living Colorado Springs

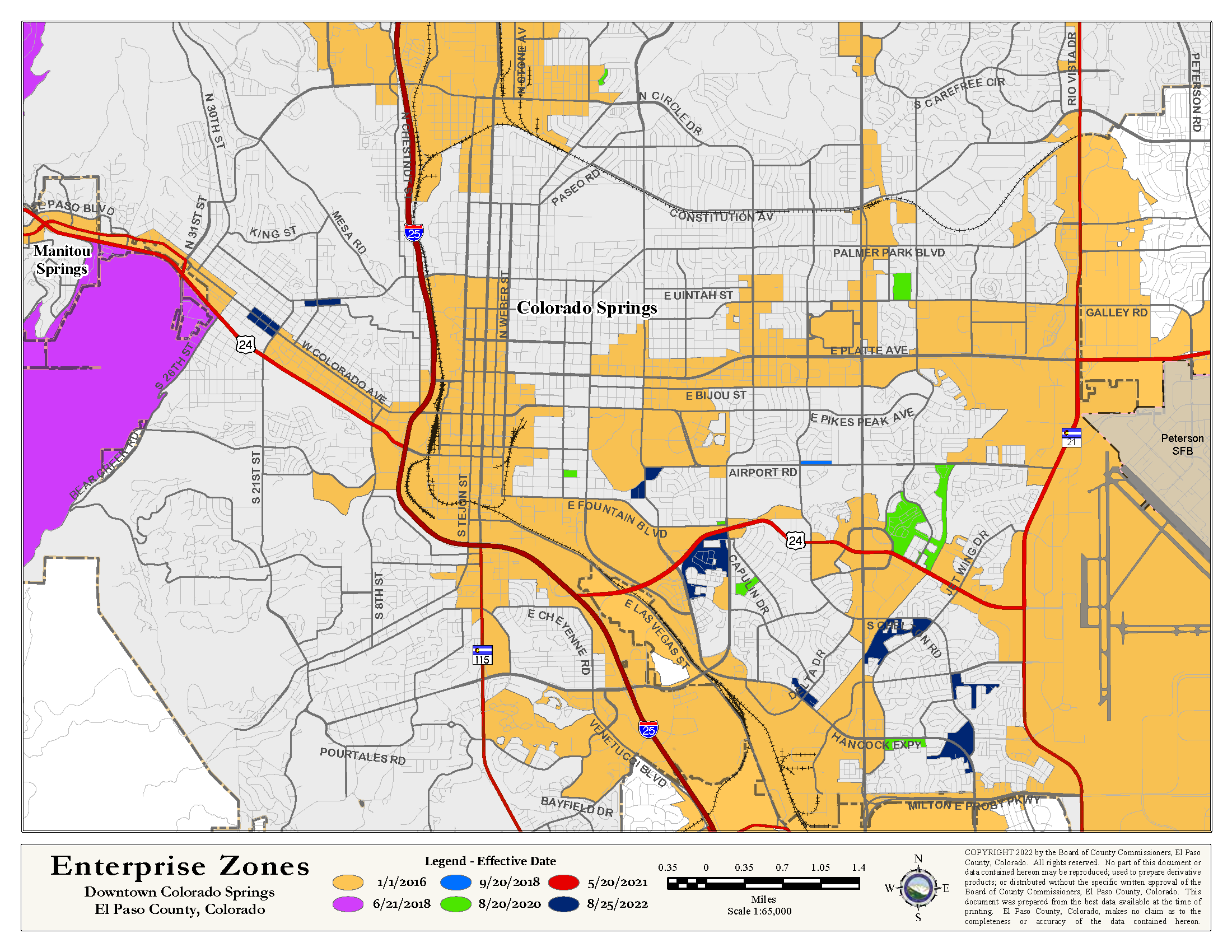

Pikes Peak Enterprise Zone El Paso County Administration

Colorado Springs Forward United We Succeed

How Colorado Taxes Work Auto Dealers Dealr Tax

Summary Of Fy 2022 Tax Proposals By The Biden Administration

Teller County Sales Tax Teller County Finance Department

What S A Pif And Why Am I Paying For It